The American Legislative Exchange Council has rated Utah as the nation’s top state in economic outlook and competitiveness for the 13th consecutive year.

SALT LAKE CITY – For the 13th consecutive year, the American Legislative Exchange Council (ALEC) has rated Utah as number one in the nation in terms of economic outlook and competitiveness.

That ranking was announced in ALEC’s 2020 edition of its annual “Rich States, Poor States” report.

The Utah Taxpayers Association (UTA) credits that ranking to the efforts of state legislators and other elected officials who are dedicated to promoting and enacting sound tax policy.

“While other states have bounced around knocking each other out of the second to fifth place,” UTA vice president Rusty Cannon explains, “it really speaks to Utah’s enviable position to remain in first place for 13 years running.”

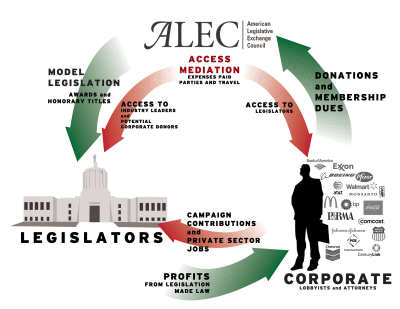

The American Legislative Exchange Council is a non-profit group with members who are state lawmakers and private sector experts who facilitate the exchange of ideas about conservative legislation on a broad range of issues, including taxation, illegal immigration, environmental regulations and voter identification among others.

ALEC’s annual ranking of states is based on 15 economic criteria, including factors like Gross Domestic Product growth, population migration, payroll employment, personal income tax rate, corporate tax rate, property tax burden, sales tax burden and state minimum wage.

“Utah’s tax and economic policies are unmatched in the nation,” Cannon argues, “with statues like our Truth-in-Taxation (TNT) law, which is a shining example for the nation and has saved Utahns billions in property taxes since your taxpayers association got it enacted in 1985.”

Prior to TNT’s enactment, local governments received an automatic tax increase when property valuations increased. The UTA successfully argued that local governments should not receive an automatic 12 percent revenue increase simply because property valuations increased 12 percent.

TNT requires that property tax rates be recalculated every year. As property valuations increase, the tax rate is reduced accordingly so that the local taxing entity does not receive an automatic revenue increase.

TNT also requires the local entity to publicly disclose its intention to increase property taxes, then conduct a public meeting to hear public reaction to the increase.

Utah drew praise from ALEC analysts for its enlightened income tax policies. The state’s income tax rate was lowered from 7 percent to a flat 5 percent in 2007 and adjusted slightly downward again to 4.95 percent in 2018.

They also noted that Utah’s corporate tax structure incentivizes businesses to relocate there by providing “… very low income tax for businesses that sell most of their products out of state.”

“Utah has a strong business environment,” Cannon agrees, “that benefits all Utahns and their families through strong job growth and increased economic activity.”

ALEC’s 2020 edition of its “Rich States, Poor States” report was based on economic data compiled prior to the coronavirus pandemic.